Our highly organized and experienced debt syndication team understands the needs of promoters to provide

a comprehensive suite of corporate finance advisory solutions packaged along with fund raising through

Banks, NBFCs, Investors etc. Our expertise provides best short term and long-term fund-raising plans

within quick turn-around time at lowest cost of funds.

Our Debt Syndication service

includes:

Our diversified expertise and strong network of business relations provides opportunity for attractive

buy and sell side business transactions and support M&A consulting and advisory services.

Our

Pre and Post Merger and Acquisition services includes:

Our exposure to wide range of businesses and diversified expertise enables us to provide end to end

services in all stages for PE& VC, i.e. from Investing and Managing the Portfolio and finally realizing

value during exit plan. We provide appropriate deal structuring, finalization of business plan,

preparation of Information Memorandum (IM), mutual negotiations for successful closure of

transaction.

Our PE & VC Funding Services includes:

Our team of experienced professionals handle SME IPO service with deep understanding of client business

and objective.

Our service in Fund raising through IPO includes:

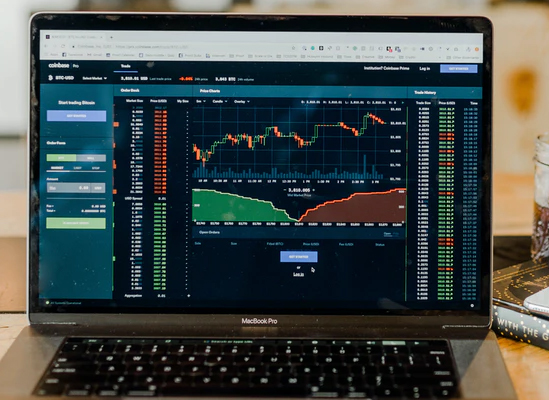

Simple and flexible portfolio performance and risk monitoring service, based on the provision of investment objective & reporting framework. It includes portfolio performance, risk, liquidity, and fee analysis, while using industry-leading fintech to provide efficient and ‘fit-for-purpose’ analysis with high quality, custom-made reports, tailored to your requirements.

Our Risk Management services includes: